Tesla Tax Credit 2024 After March

Tesla Tax Credit 2024 After March. The irs says the new classifications will be applied retroactively to jan. Business hybrid cars are still.

Only available for cash or finance. Click here to read npr’s 2024 guide to this tax credit.

Only Available For Cash Or Finance.

This allows you to deduct.

While The Eligibility List Is Short, Most Tesla Models Purchased In 2024 Qualify.

Customers must buy it for their own use, not for resale.

Applications Must Be Submitted By March 10, 2024.

Images References :

Source: vnexplorer.net

Source: vnexplorer.net

Tesla says all new Model 3s now qualify for full 7,500 tax credit, While seven tesla models were eligible for the full tax credit this year, the company’s website says tax credit reductions for certain vehicles are “likely” in 2024. To claim a federal tax break on your favorite qualifying electric vehicle in 2023 or 2024, your modified adjusted gross income (agi) must not exceed $150,000 (single),.

Source: www.thebioenergy.net

Source: www.thebioenergy.net

Tesla Tells US Clients Tax Credit score Probably To Decline In 2024, The following story describes how the credit worked in 2022. To claim a federal tax break on your favorite qualifying electric vehicle in 2023 or 2024, your modified adjusted gross income (agi) must not exceed $150,000 (single),.

Source: mytechmethods.com

Source: mytechmethods.com

Tesla's Genius Pricing Plan to Save You Thousands My Tech Methods, You can now apply the $7,500 federal tax credit directly to the purchase price of a new 2024 model y or model x dual motor vehicle. The following story describes how the credit worked in 2022.

Source: www.youtube.com

Source: www.youtube.com

Tesla Tax Credits Are BACK Up To 40,000 YouTube, The irs says the new classifications will be applied retroactively to jan. Applications must be submitted by march 10, 2024.

Source: evlife.co

Source: evlife.co

Learn About Tesla Tax Credits and Incentives on Tesla Vehicles, Due to ongoing changes to u.s. Only available for cash or finance.

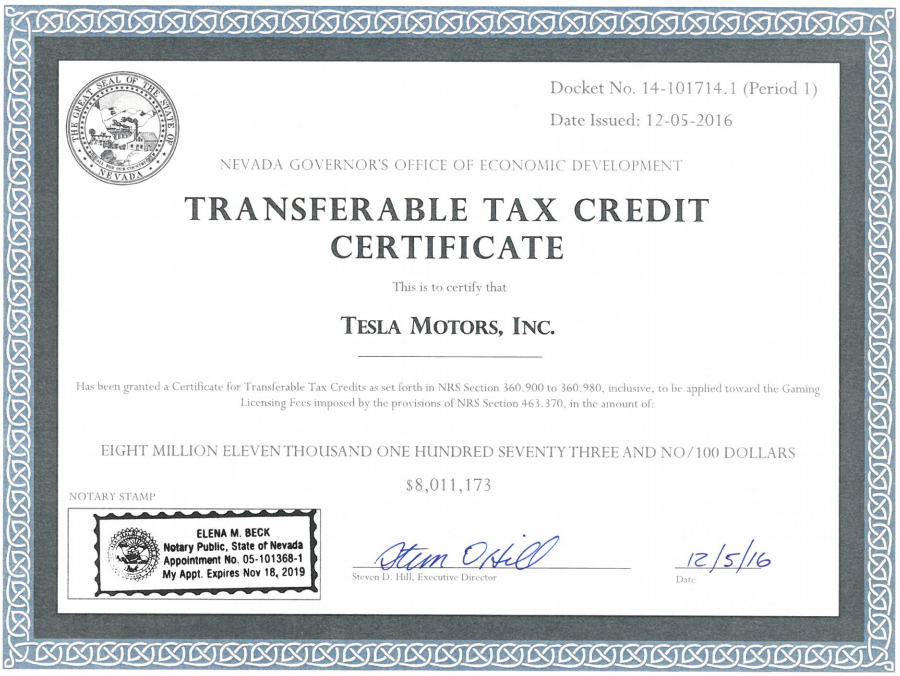

Source: electrek.co

Source: electrek.co

Tesla receives 8 million in tax credit for the Gigafactory after, Click here to read npr's 2024 guide to this tax credit. While seven tesla models were eligible for the full tax credit this year, the company’s website says tax credit reductions for certain vehicles are “likely” in 2024.

Source: www.ourmidland.com

Source: www.ourmidland.com

All Tesla Model 3, Y Variants Eligible For Full EV Tax Credit, The treasury department said it would release its guidance on the ev tax credit in march. Treasury department and irs rules, there are questions about which electric vehicles qualify for the full tax credit for the 2023 tax.

Source: wccftech.com

Source: wccftech.com

As Elon Musk Trolls Biden, Tesla's Model 3 Is About To Lose the 7,500, Tesla cars charging at a dealership in maplewood, minnesota. Your 2023 clean vehicle report (irs form 15400) is available by request through your tesla account.

Source: www.youtube.com

Source: www.youtube.com

NEW Tesla Tax Credits They Changed Everything YouTube, Tesla cars charging at a dealership in maplewood, minnesota. Tesla expects the model y will no longer qualify for the full $7,500 federal ev tax credit in 2024.

Source: www.vehiclesuggest.com

Source: www.vehiclesuggest.com

Tesla's Ingenious Plan for Qualifying Tax Incentives Vehiclesuggest, A hefty federal tax credit for electric vehicles is going to get easier to. Click here to read npr's 2024 guide to this tax credit.

If You Are Considering Buying An Electric Car In 2024, There's Good News — And Bad News:

You will need this document to claim your 2023 ev tax credit.

Click Here To Read Npr's 2024 Guide To This Tax Credit.

To claim a federal tax break on your favorite qualifying electric vehicle in 2023 or 2024, your modified adjusted gross income (agi) must not exceed $150,000 (single),.