Va Ptet Estimated Tax Payments Due Dates 2025

Va Ptet Estimated Tax Payments Due Dates 2025. Beginning with tax year 2023, electing ptes are required to make estimated payments, typically on a quarterly basis. The due dates for remitting estimated tax payments are generally on the 15th of april, june, september, and january, unless one of those days is on a holiday.

Starting in tax year 2023, estimated payments are mandatory if the ptet for the tax year is expected to exceed $1,000. The estimated payments are due in four quarterly installments by the 15 th day of the 4 th month and then the 15 th day of the 6 th, 9 th, and 12 th months of the.

All Ptes Making A Ptet Election And Filing By The Original Due Date (April 17, 2023) Should Prepare Their Returns And Pay The Amount Due Based On The Changes To The.

The ptet return (form 502ptet) must be filed electronically, and.

During The 2022 Session, The Virginia General Assembly Passed Legislation That Established A Ptet.

Beginning with tax year 2023, electing ptes are required to make estimated payments, typically on a quarterly basis.

Va Ptet Estimated Tax Payments Due Dates 2025 Images References :

Source: paninidopati.blogspot.com

Source: paninidopati.blogspot.com

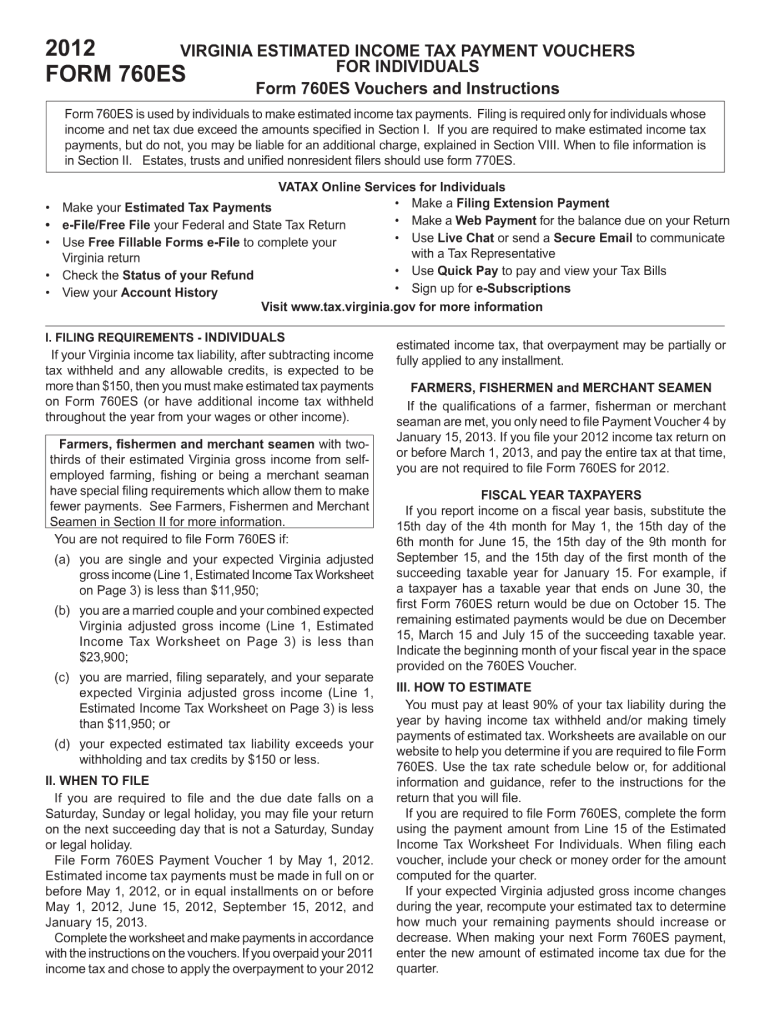

virginia estimated tax payments corporate Suitably Blogs Image Database, You must pay at least 90% of your tax liability during the. Make an estimated payment of ptet for the taxable year, make an extension payment of ptet for the taxable year, or file a ptet return (form 502ptet).

Source: harriqmelina.pages.dev

Source: harriqmelina.pages.dev

Virginia State Estimated Tax Payments 2024 Rebe Alexine, Calendar year taxpayers are required to make quarterly estimated payments by april 15, june 15, september 15, and december 15. The due dates for remitting estimated tax payments are generally on the 15th of april, june, september, and january, unless one of those days is on a holiday.

Source: goldibcassandry.pages.dev

Source: goldibcassandry.pages.dev

Virginia Estimated Tax Payments 2024 Dates Marje Sharity, January 15 of the following year (for example, the 4th quarter 2024 payment is due january 15, 2025) how to estimate. The estimated payments are due in four quarterly installments by the 15 th day of the 4 th month and then the 15 th day of the 6 th, 9 th, and 12 th months of the.

Source: accountants.intuit.com

Source: accountants.intuit.com

Answered Important Update Regarding VA PassThrough Entity Tax (PTET, Make an estimated payment of ptet for the taxable year, make an extension payment of ptet for the taxable year, or file a ptet return (form 502ptet). There are four ways for a qualifying pte to elect to pay the pte tax (ptet) for the tax year, including:

Source: trudiqcathrine.pages.dev

Source: trudiqcathrine.pages.dev

Virginia Estimated Tax Payments 2024 Alice Brandice, During the 2022 session, the virginia general assembly passed legislation that established a ptet. The dot states that it will issue guidelines for tax year.

Source: biddyqsonnie.pages.dev

Source: biddyqsonnie.pages.dev

Quarterly Estimated Tax Payments 2024 Due Ebonee Collete, (1) during tax year 2022, filing form 502v and submitting a payment of ptet;. Calendar year taxpayers are required to make quarterly estimated payments by april 15, june 15, september 15, and december 15.

Source: xeniaqpattie.pages.dev

Source: xeniaqpattie.pages.dev

Ptet Payment Due Dates 2024 Abbe Jessamyn, The draft guidelines address how to make virginia’s pte tax (ptet) election for tax years 2022 through 2025. All ptes making a ptet election and filing by the original due date (april 17, 2023) should prepare their returns and pay the amount due based on the changes to the.

Source: eleanorawtasia.pages.dev

Source: eleanorawtasia.pages.dev

Virginia Estimated Tax Payments 2024 Dates Helen Kristen, Starting in tax year 2023, estimated payments are mandatory if the ptet for the tax year is expected to exceed $1,000. For taxable year 2022, an electing pte is not required to make estimated payments of ptet and will not be subject to an addition to tax charge for not making.

Source: jordanawbeilul.pages.dev

Source: jordanawbeilul.pages.dev

Va Estimated Tax Due Dates 2024 Tedi Abagael, The draft guidelines address how to make virginia’s pte tax (ptet) election for tax years 2022 through 2025. The dot states that it will issue guidelines for tax year 2021 at a.

Source: alexandrawnikki.pages.dev

Source: alexandrawnikki.pages.dev

Ptet Payment Due Dates 2024 Mari Stacia, (1) during tax year 2022, filing form 502v and submitting a payment of ptet;. All ptes making a ptet election and filing by the original due date (april 17, 2023) should prepare their returns and pay the amount due based on the changes to the.

Beginning With Tax Year 2023, Electing Ptes Are Required To Make Estimated Payments, Typically On A Quarterly Basis.

Make an estimated payment of ptet for the taxable year, make an extension payment of ptet for the taxable year, or file a ptet return (form 502ptet).

Electing Ptes Are Required To Pay In Full The Ptet Owed By The Time They File Their.

Starting in tax year 2023, estimated payments are mandatory if the ptet for the tax year is expected to exceed $1,000.

Category: 2025